BTR – A Rising Star

Build-To-Rent (BTR) is proving to be the rising asset star in the Private Rented Sector (PRS). But why is it so attractive right now?

Demand

About 2.7 million Londoners are renters, and over the next decade, this number is set to rise by 122%, with renters outnumbering homeowners by 2039. Naturally, BTR buildings will be best placed to meet this growing demand not just in London but in its suburbs too.

Today and tomorrow’s renters will mainly be young professionals unable/ choosing not to get on the property ladder, searching out well-located buildings in city centres or electing to be near green spaces with retail shopping and transport links close by. They will also take advantage of services like, housekeeping, dry cleaning, laundry, etc.

When sons and daughters are no longer at home, parents realize that downsizing their home allows them to take advantage of either retiring earlier or simply spending some of the money invested in their homes on themselves. Empty nesters are looking for easy living too. Things like having a garden to sit in but not having to maintain it and no more worries about replacing appliances, etc. Having an onsite team of staff to assist will be sought after by this group, as personal face-to-face connections are still important.

Safety and security are primary concerns for families. Safety in knowing a building is professionally operated and a diligent management team is constantly monitoring and mitigating risks. Security that most buildings will have 24/7 staffing to make sure that they are secure. Again, a family looks for things to make daily life easier. If they need their home cleaned after a child’s birthday party, they will book the cleaning service on the BTR operator’s app. They will also look for well-located buildings, in more suburban areas in this case, more green space with good schools nearby and with retail shopping and excellent transport links.

With growing hospitals, airports, universities and companies, London and its suburbs will continue to expand. When you add in today’s ‘social distancing’ environment, more space will likely be preferred/ demanded. People need and want quality places to live, in good locations, with services to make their lives more enjoyable. This is what BTR can provide.

Supply

It is often stated by many that there is a shortage of housing in the UK. This undersupply becomes more acute when you start to look at the quality of housing too.

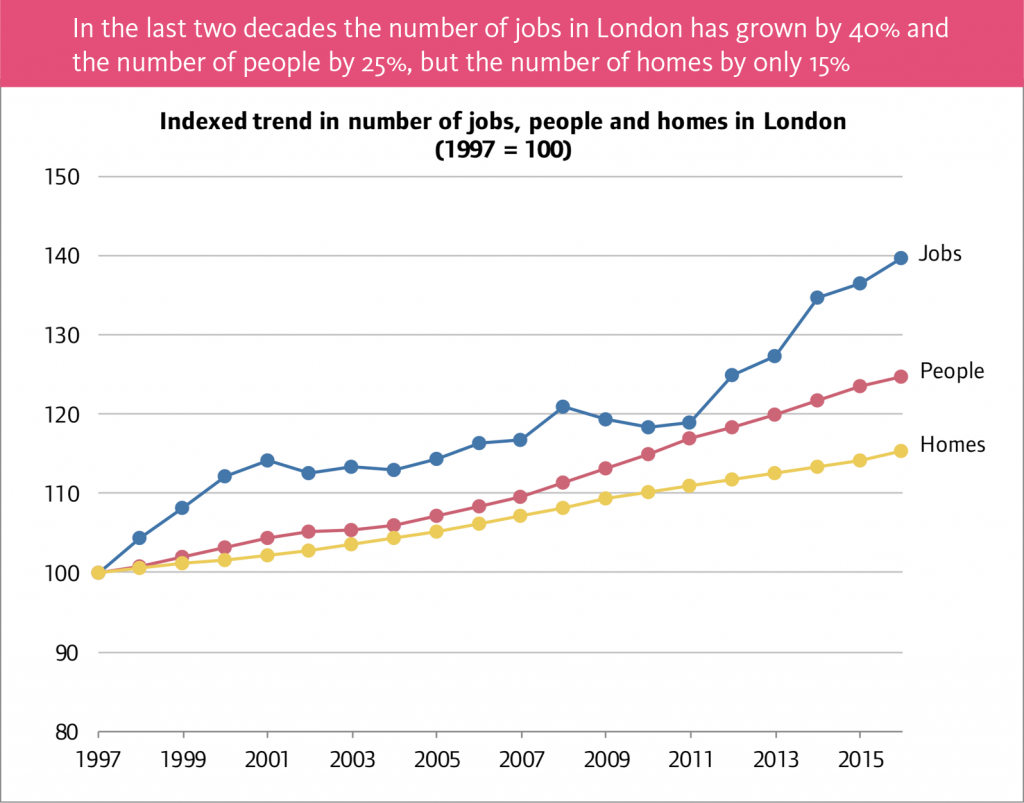

Source: Greater London Authority, February 2017. Housing in London: 2017 The evidence base for the Mayor’s Housing Strategy.

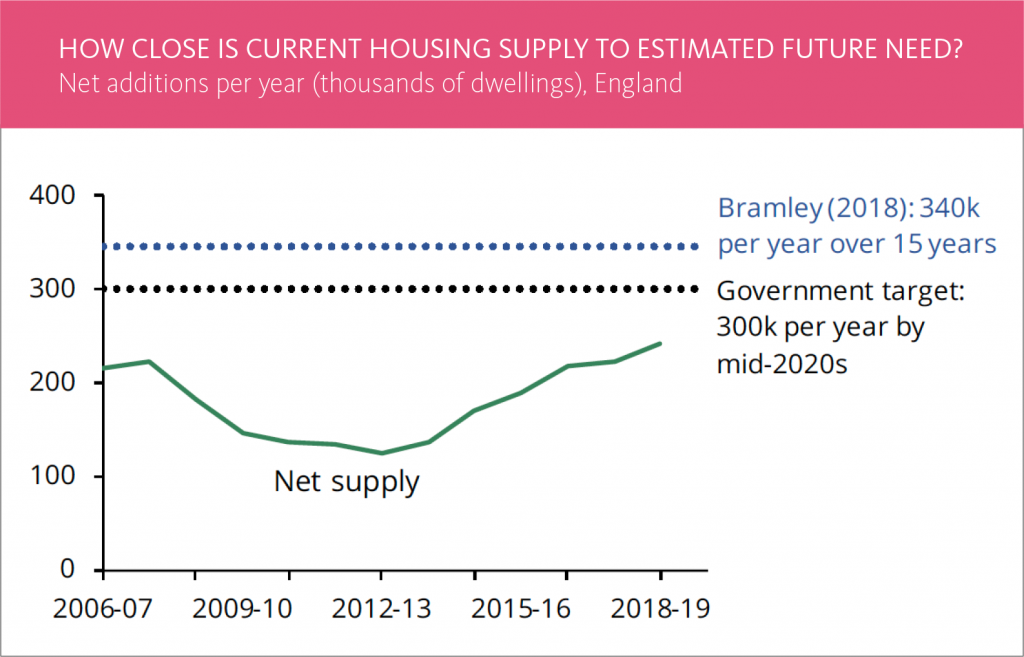

The chart below shows net supply in each year since 2006-07. Net supply had been increasing in recent years, from low point of around 125,000 in 2012-13 to around 241,000 in 2018-19. Annual net supply would need to increase by around another 24% by the mid-2020s to meet the government’s target, and by another 43% to reach the 340,000 per year called for by Crisis and the NHF.

Data used in graph from MHLCG, Live table 120; ONS, Household projections for England: 2016 based; estimated need referenced in the graph.

Source: House of Commons Library. BRIEFING PAPER, Number 07671, 9 March 2020. ‘Tackling the under-supply of housing in England’.

BTR is one way in which property developers are attempting to tackle the housing shortage. The BTR sector is growing 20% year-on-year (BPF) and investment is reaching over £10.6bn. In the first quarter of 2020 alone, the number of completed BTR homes increased by 42% compared to the same period last year. This is highlighted in the number of units in planning, which has soared by 23% to 77,446 this year. Even so, there is a long way to go before supply meets demand.

Investment Yields and Resilience

BTR is a tested asset class abroad. In the United States, it’s called “multifamily” with well built and operated buildings producing returns for investors with up to 9% yields in established markets. In the UK, BTR yields are ranging from 3.25% to 5.5% across England.

The common denominator in the US Multi-family market and the UK BTR market is stability. The US Multifamily sector was sustainable and recovered quickly following the financial crash of 2008. It is expected that this will hold true again in today’s economic uncertainty, and early indications are already showing that built and operating BTR buildings in the UK are faring well.

In the UK, we have heard from retail property investors looking to turn towards residential investments, knowing the high street retail shops will take a significantly longer time to recover. As today’s remote working environment has been forced upon us, many companies have realized that they don’t need as much office space, so we anticipate office investors looking to BTR investments as an alternative too. Similarly, comparing UK residential property investment to bonds, shares, and commodities, the projection for stable and consistent returns is far more likely.

Final thoughts

Over the next few years BTR is set to become a mainstream solution for renters and a good investment for institutions. Strawberry Star is well-poised for the future with several BTR opportunities in our pipeline.

Click here to read more about our BTR platform.

For further information or insights into BTR contact Clint Bartman